Digital Banking Experience

Optimize digital experiences to improve satisfaction and reduce customer effort

Summary

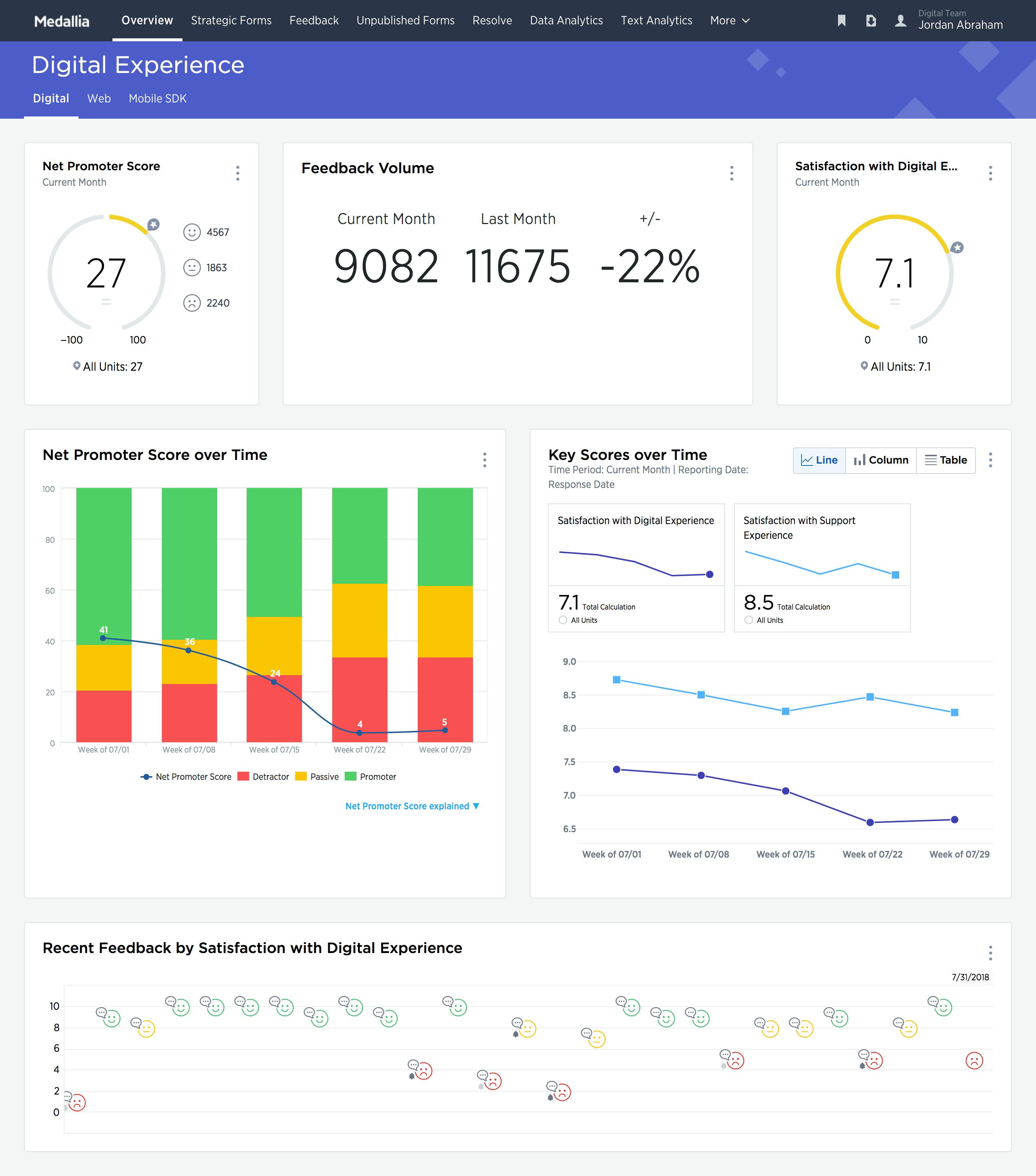

With the majority of customer banking interactions happening in digital channels, getting the digital experience right is critical for banks. Banks are thinking ‘mobile-first’ and investing in digital capabilities. Digital Banking Experience helps banks make sure that their investments are delivering what the customer wants.

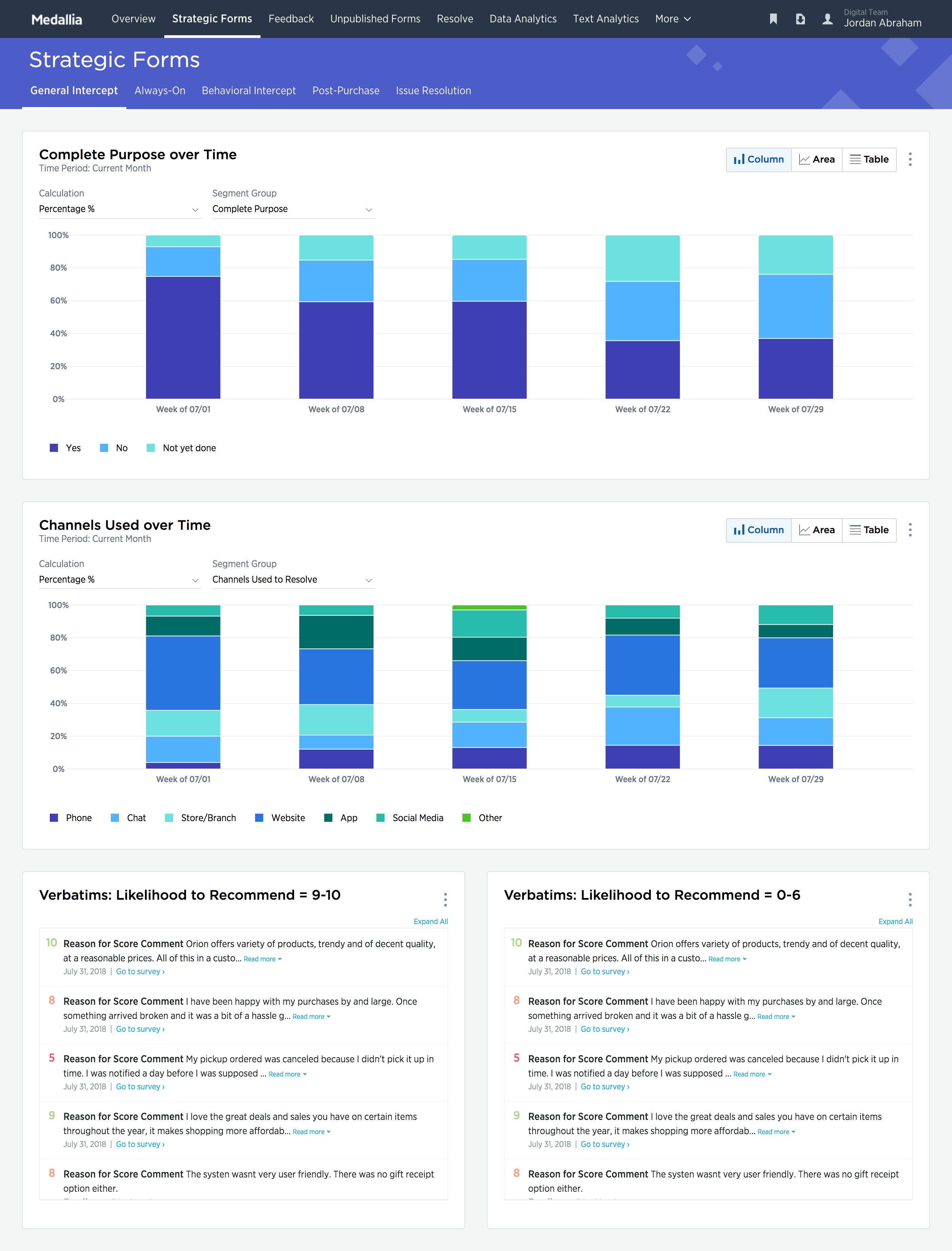

Supporting both digital and cross-functional teams – servicing, bankers and product managers – who rely on the digital channel to perform within a broader omnichannel experience, Digital Banking Experience helps teams quickly understand comprehensive digital journeys, recover customers who provide negative feedback, and perform root cause analysis by tagging and categorizing specific digital issues. This allows customers to complete the transactions they want with minimal effort, and reduces transaction volume in human channels.

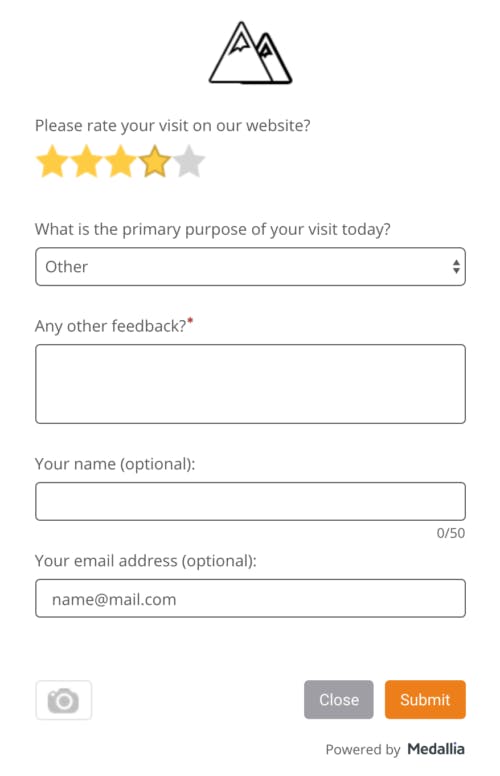

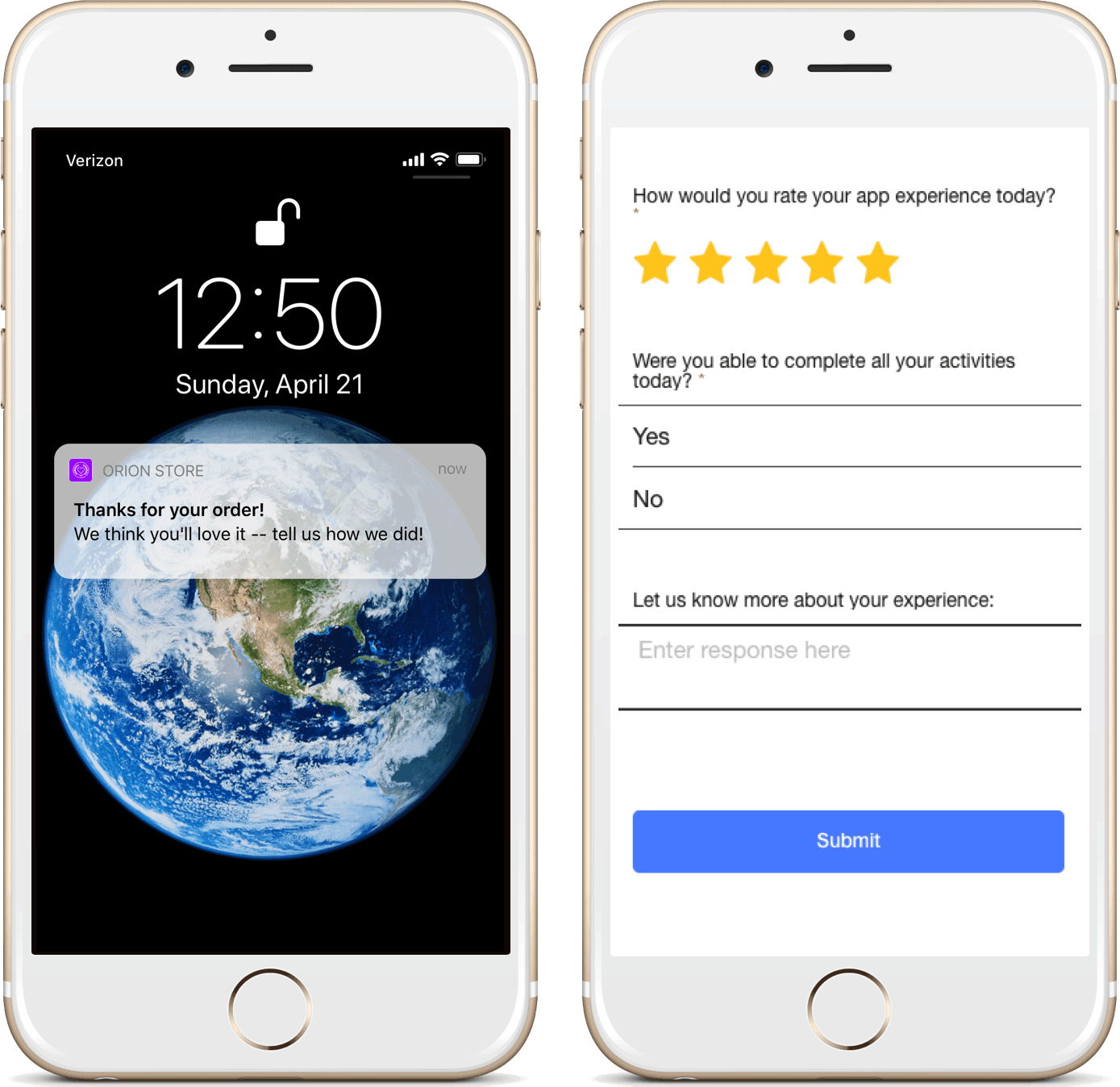

Whether refining the experience on a self-service mobile app, simplifying an online portal, or designing a new financial education tool, continuously capturing actionable customer experience and feedback is critical to a successful digital strategy.

What’s Included:

- Survey templates that span the digital journey: learn, apply, onboard, and use

- Support for full flexibility in form design and targeting

- Mobile SDK for in-app survey deployment

- Digital Anywhere API for survey deployment and feedback analysis within connected devices

- Ability to integrate with web analytics, ticketing, chat, and session recording providers

- Role-based reporting for digital administrators and digital CX teams, designed to surface insights and enable rapid issue categorization and follow-up

- Alerts and workflows to auto-categorize high volumes of digital feedback

- Support for Text Analytics, with pre-built digital and banking topic sets

Schedule a Consultation with an Expert

Thank you

Your message has been received and we will contact you shortly.