Inflation continues to make an impact on buying decisions — here are the consumer trends you need to know right now.

We saw major consumer behavior shifts across 2020 and 2021, and this year has brought on more changes. While the Covid-19 pandemic fueled much of this upheaval initially, more recently, labor and supply shortages, geopolitical tensions, stock market volatility, and inflation have grown to be dominant forces, with inflation being the leading driver of consumer trends in 2022.

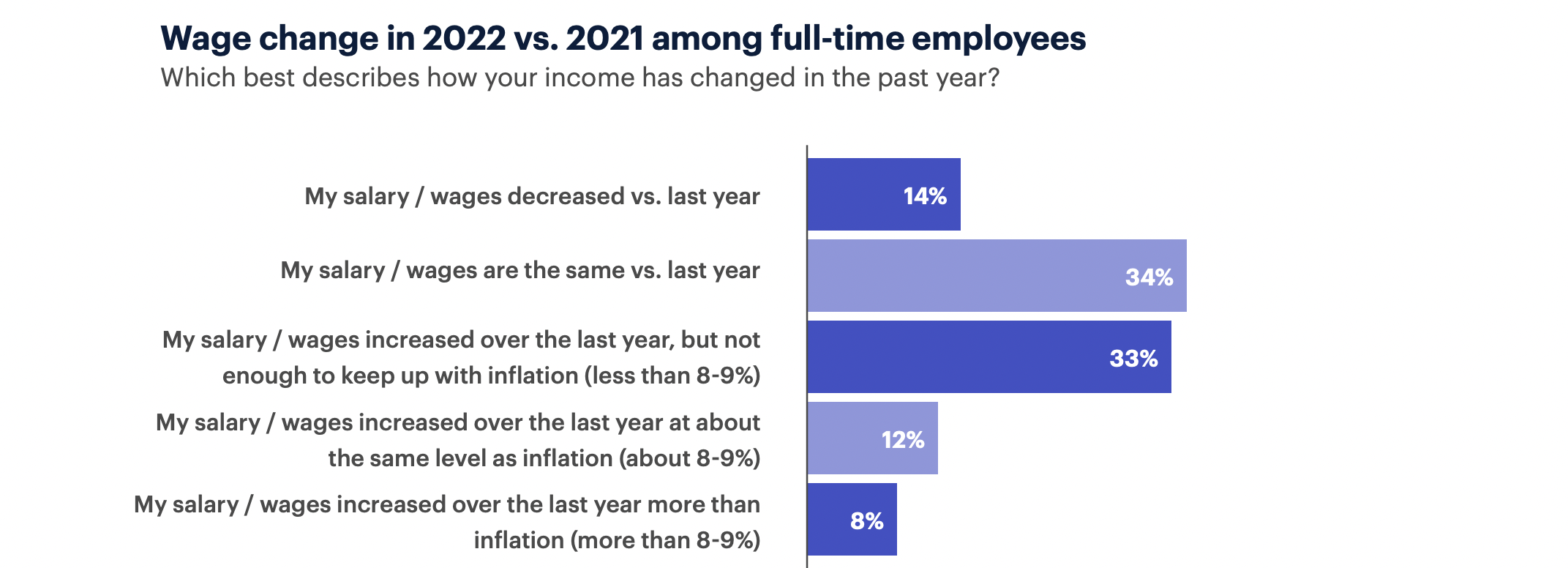

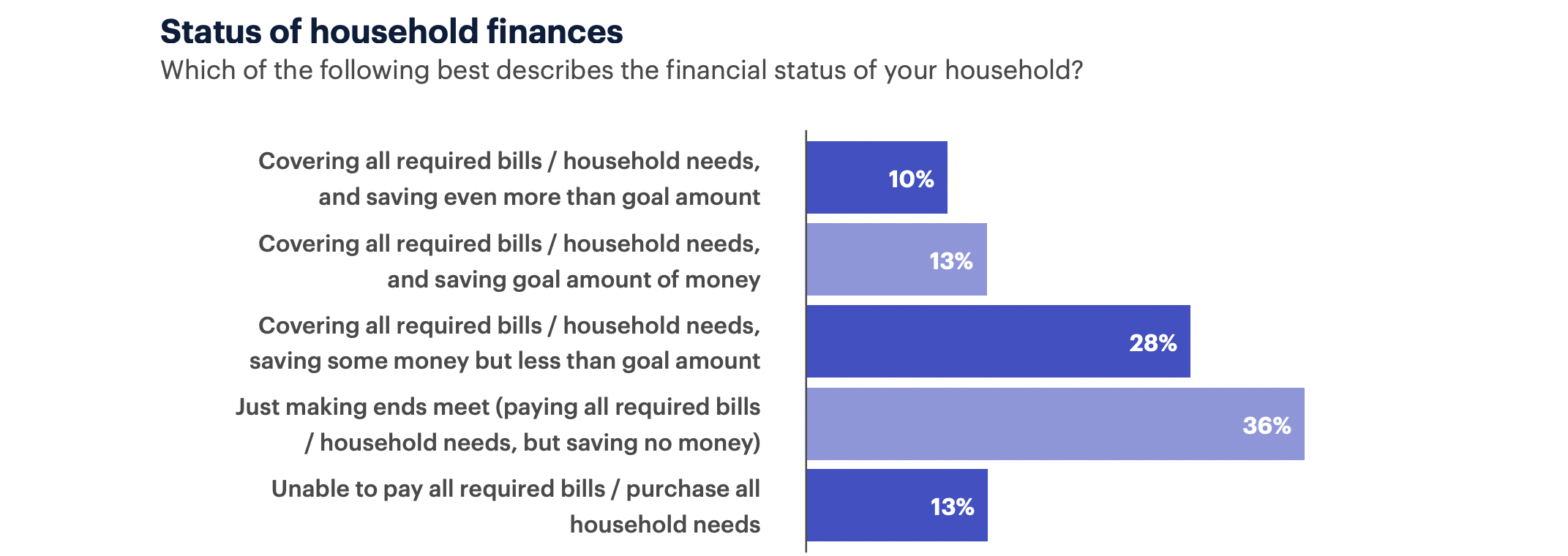

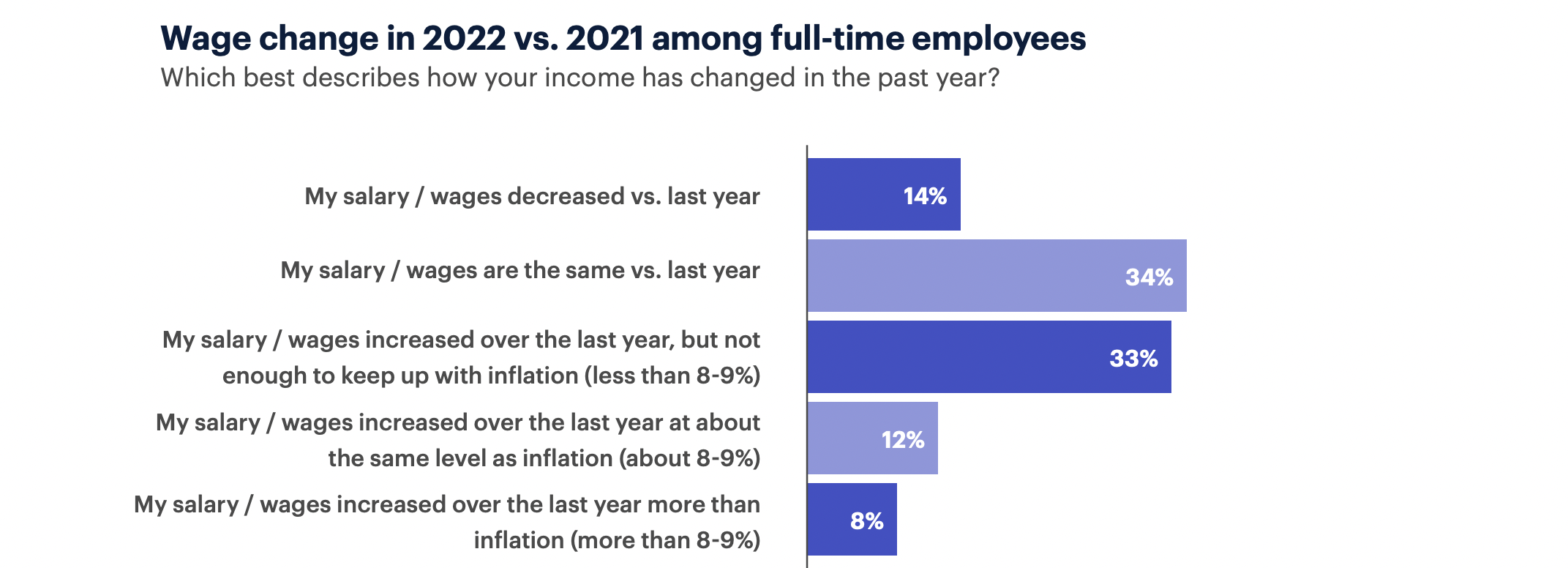

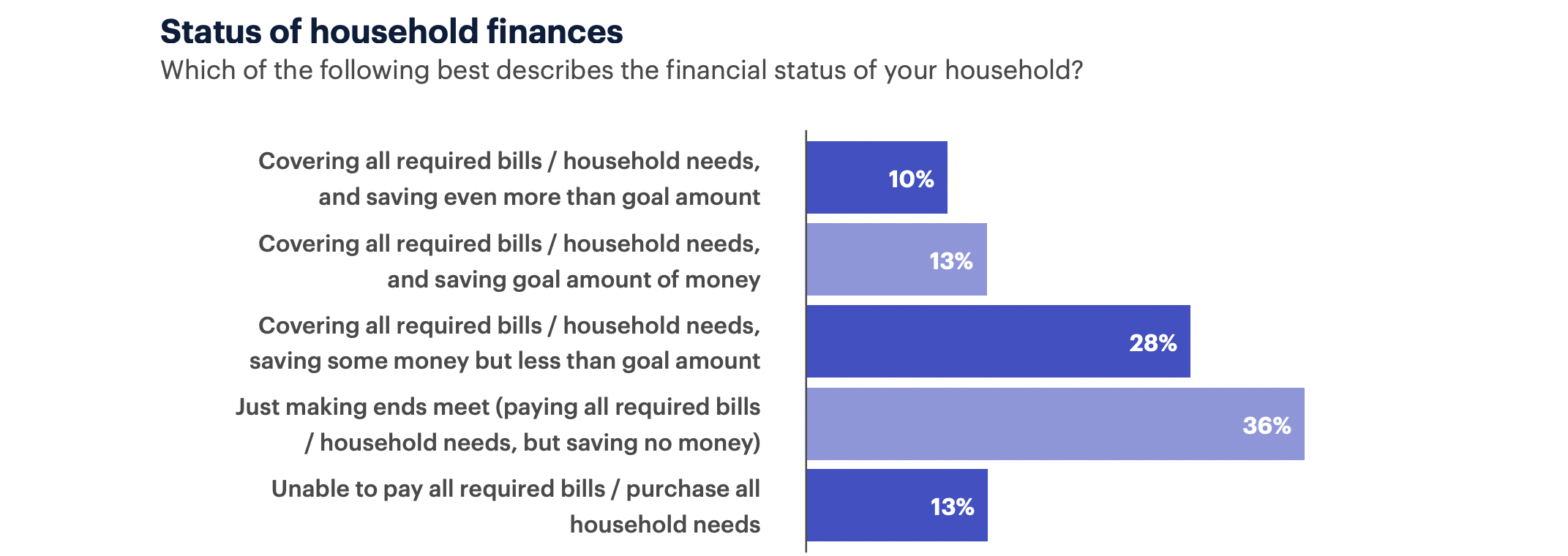

As of this writing, inflation currently sits at 10.9%. With prices climbing faster than we’ve seen in decades, less than 10% of consumers say their salary / wages increased more than the rate of inflation over the last year (that is, by more than 8-9%), and, at the same time, only 23% of consumers say they’re able to cover all of their bills and meet or exceed their goal savings amount.

Two key findings from Medallia Market Research’s report, Consumer Reactions to Inflation, help to understand how inflation is impacting the day-to-day lives of consumers — both are centered around personal finances.

Consumers overwhelmingly feel that compensation hasn’t kept up with inflation. In the report, most consumers say their wages are unchanged compared to 2021. Others, meanwhile, say they received an increase in compensation but the boost in pay isn’t enough to outpace inflation. Consumers also point out that they’re struggling to make ends meet, and many others are saving significantly less than they’d prefer.

Consumers also point out that they’re struggling to make ends meet, and many others are saving significantly less than they’d prefer.

Inflation takes aim at the everyday buying decisions of all consumers, which is why it’s important as a brand to understand its effects and take action that addresses the current environment.

About the Data in Consumer Reactions to Inflation

Medallia Market Research combines massive amounts of consumer data — across consumer spend, foot traffic, and survey panels — to answer tough questions for top brands in the United States.

Our transaction panel includes the credit and debit card spend of over 5 million consumers. Beyond that, our smartphone geolocation panel tracks the movement activity of over 5 million opted-in consumers to uncover top foot traffic patterns across U.S. business locations. Plus, our survey panel is the largest U.S. panel of visit-based survey takers who can be tracked 24/7 and surveyed immediately after their visits to brick-and-mortar locations or websites.

For this particular study on inflation and consumer trends in 2022, we analyzed credit/debit transactions across a variety of retail sectors to quantify changes in consumer spending as a result of inflation. We also surveyed 4,035 consumers to explore the reasons behind their behavior.

5 Ways Inflation is Shaping Consumer Trends

Consumers are more price-sensitive. As a result, they’re cutting back, but these shifts have been uneven across product categories, leaving some industries more vulnerable to changing consumer behavior than others.

Here’s what you need to know about how inflation is affecting consumer trends in 2022 — and what your organization can do to adapt and get ahead of the competition.

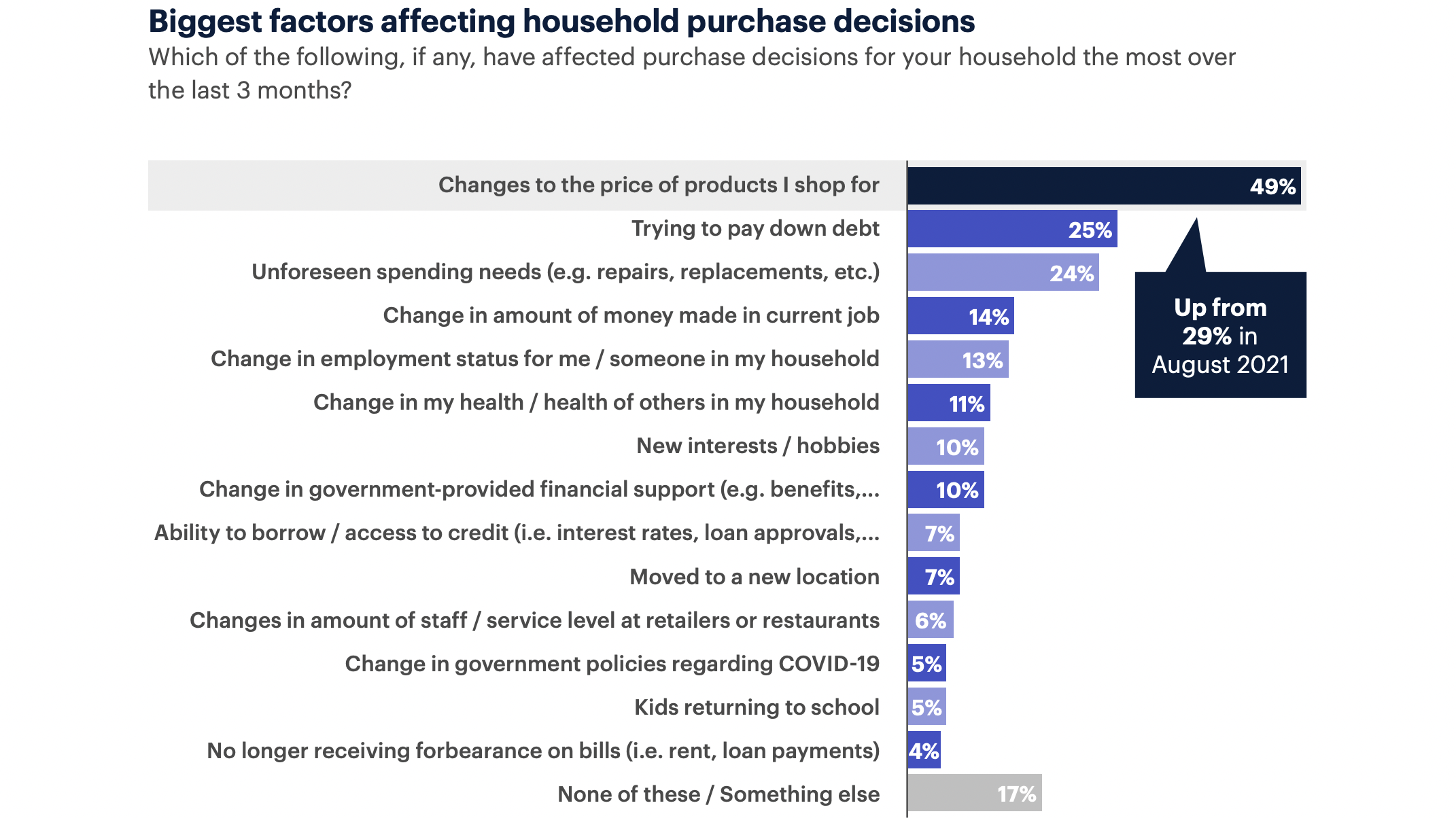

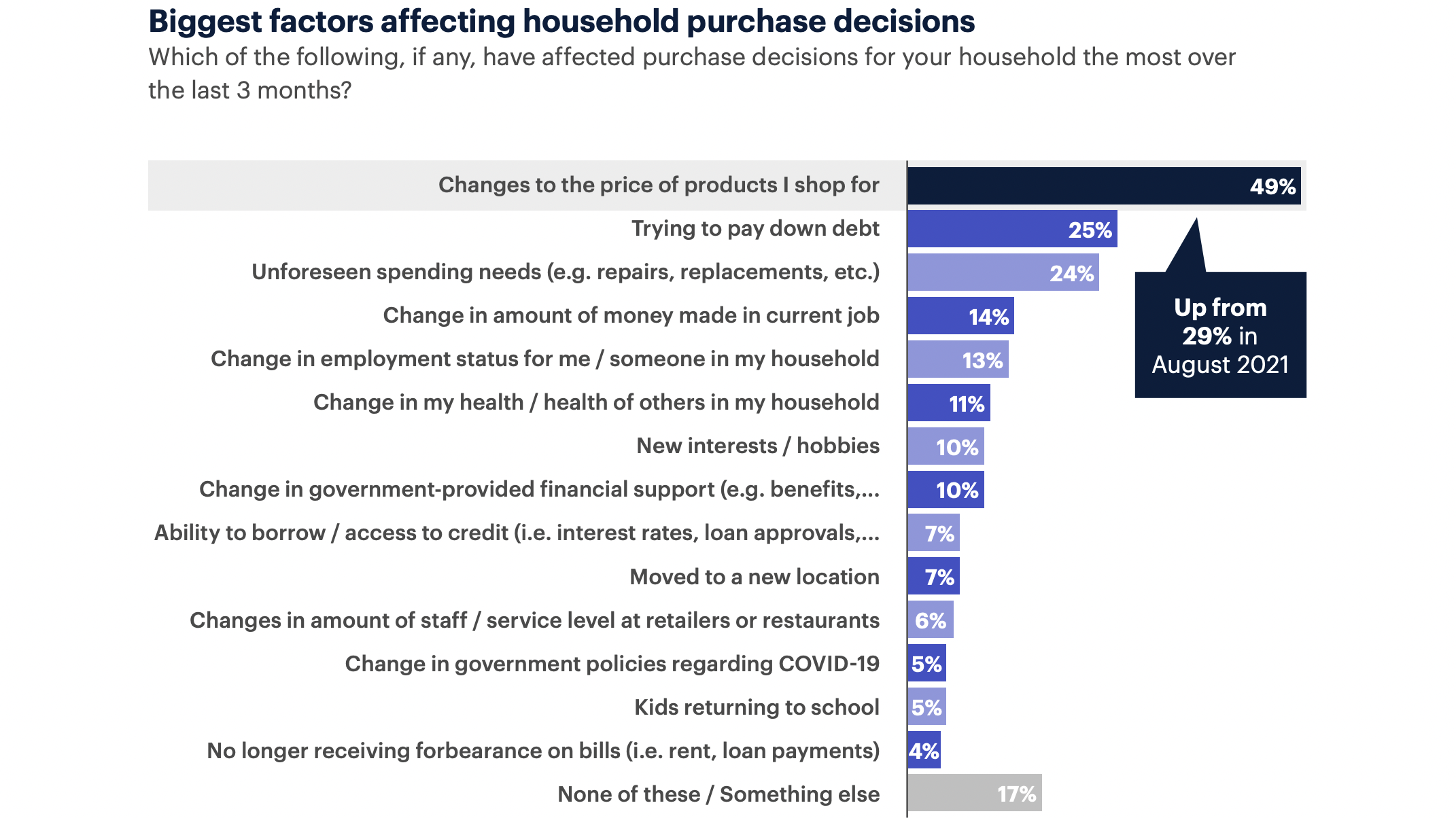

1. The price of products is now the #1 factor that influences household spending. Nearly half of all consumers (49%) say price has influenced their purchase decisions over the last three month — that’s up by 20 percentage points from 29% of consumers who said the same thing in August 2021.

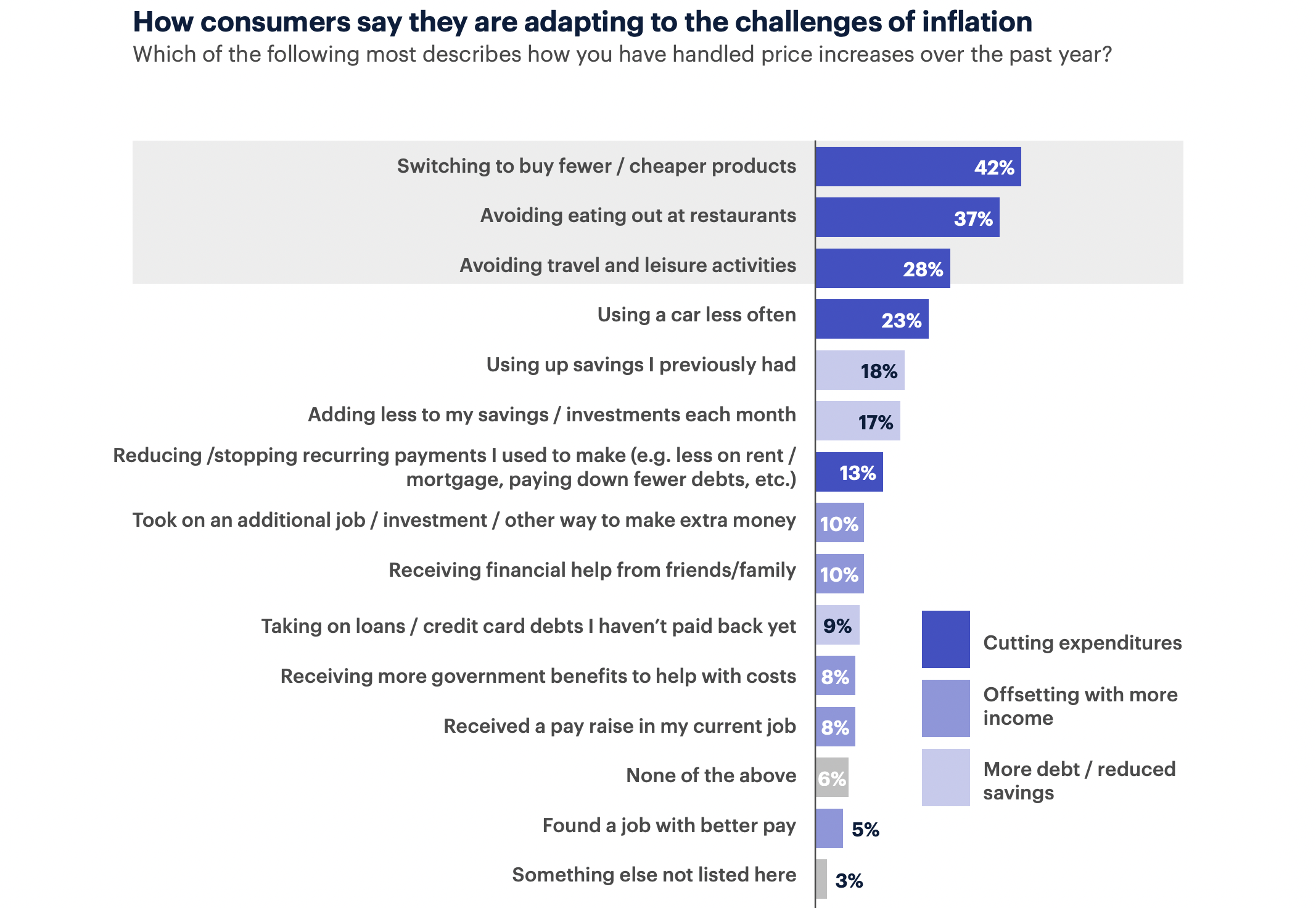

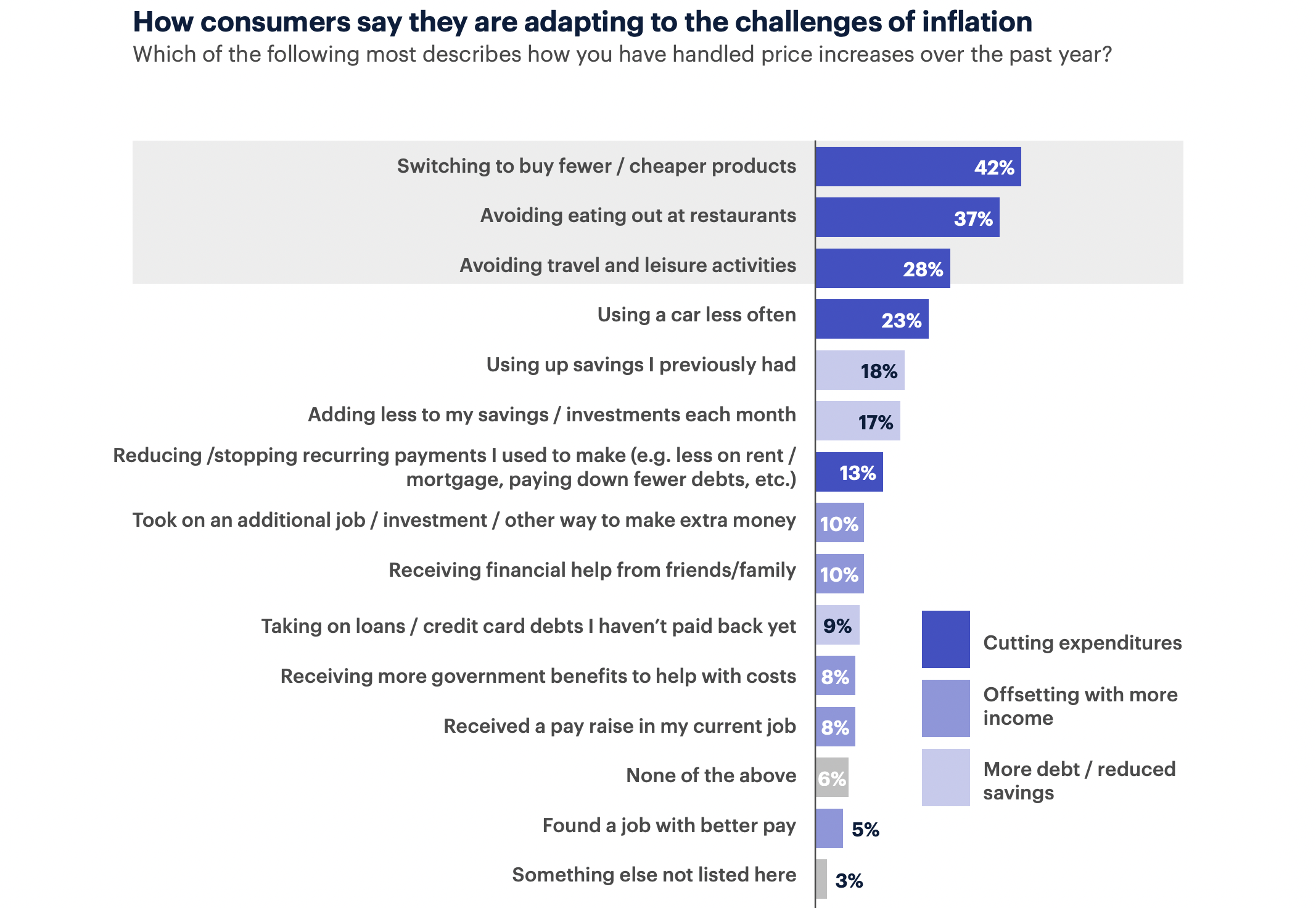

2. Nearly half of consumers (42%) say they’re handling price increases by switching to buying fewer / cheaper products. A smaller number have turned to finding additional sources of income or are turning to reduced savings / more debt to adjust to inflation.

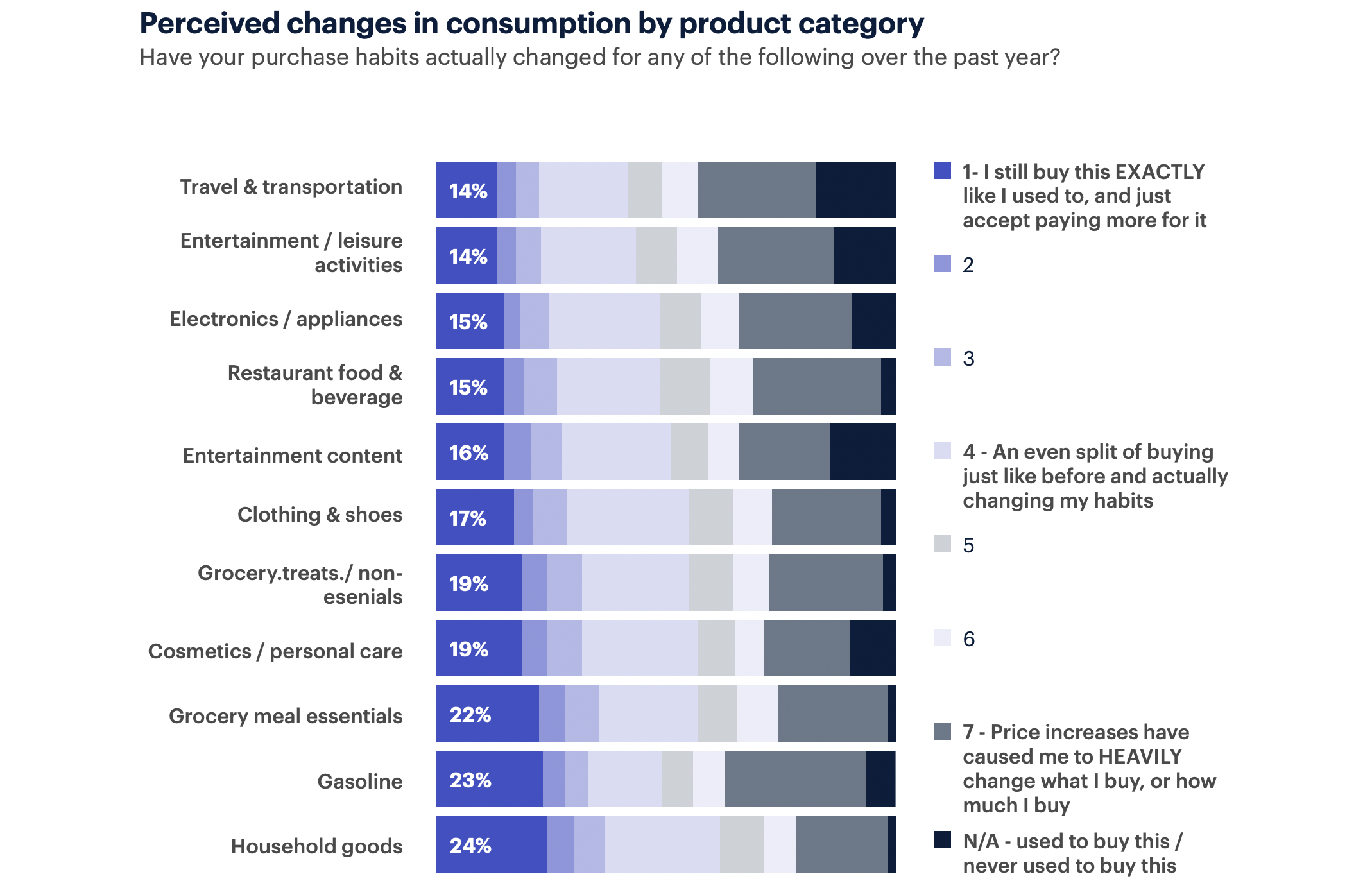

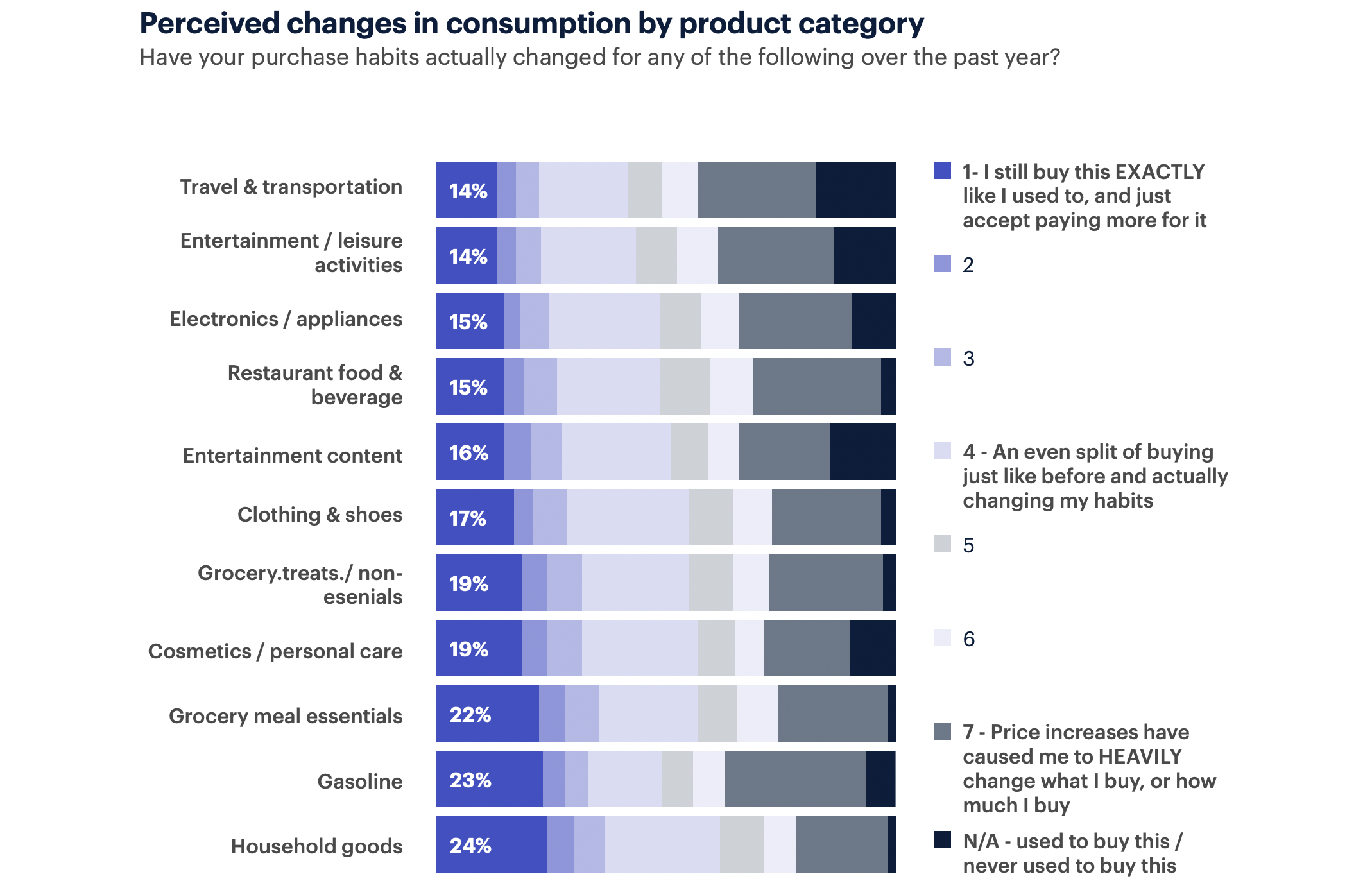

3. Consumers have made the biggest spending changes within “nice to have” product categories, including travel and entertainment. Conversely, they have made the least changes to their spending habits within more essential product categories, including household goods and gasoline.

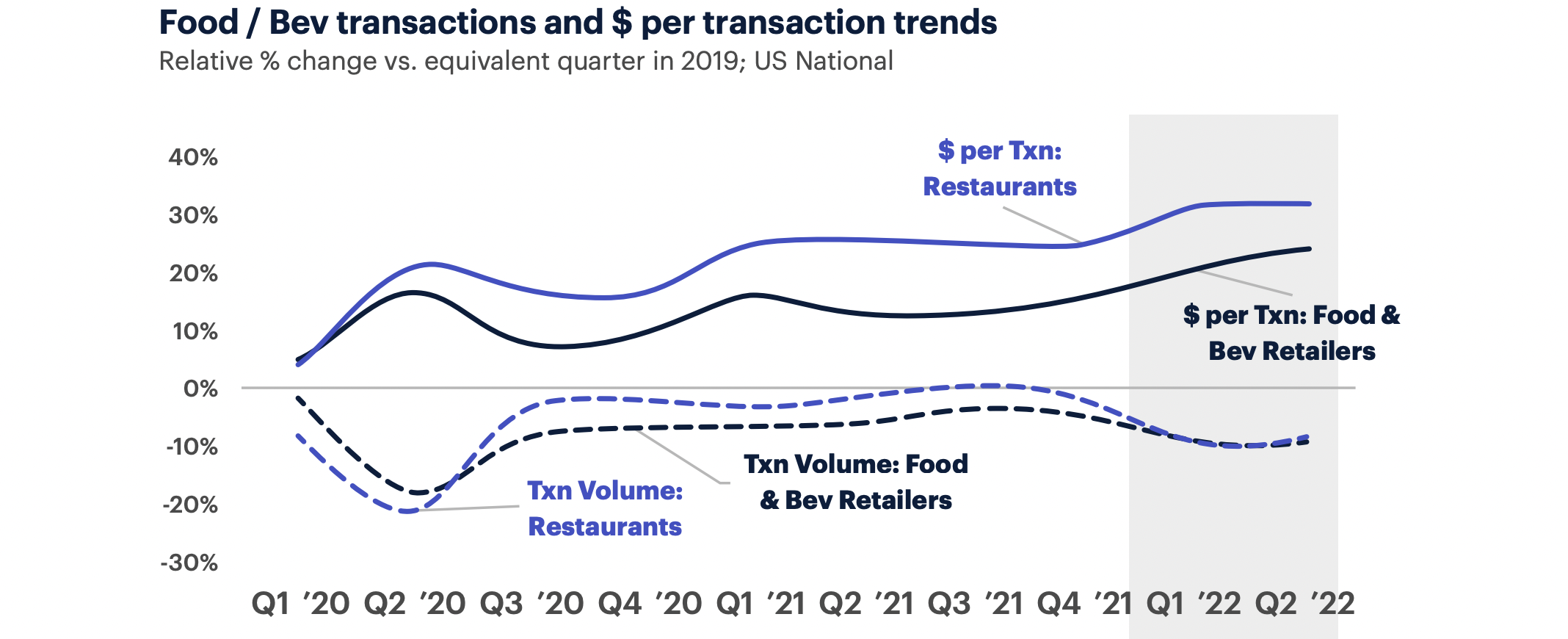

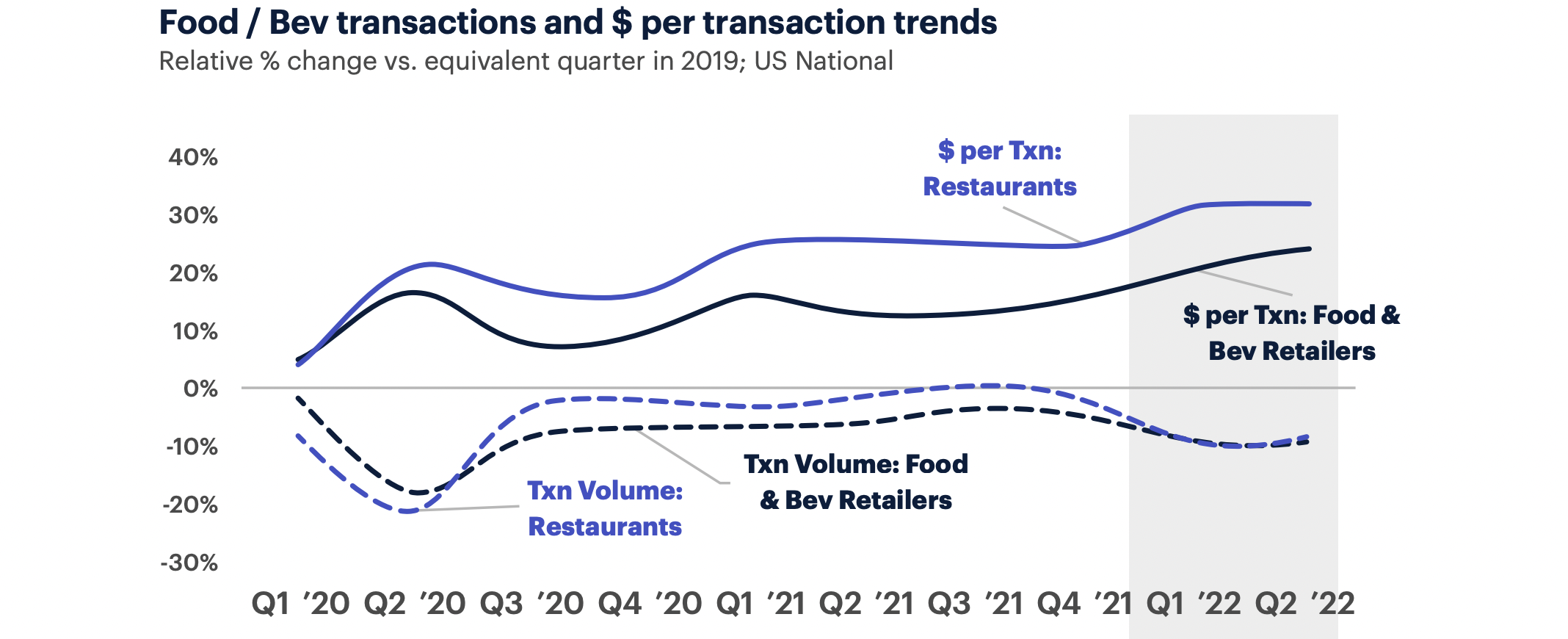

4. Consumer transactions at restaurants and grocery stores have slowed down in the first half of 2022, after being up by the end of 2021 compared with spring 2020 levels. Because prices have increased, however, overall spend per transaction is up.

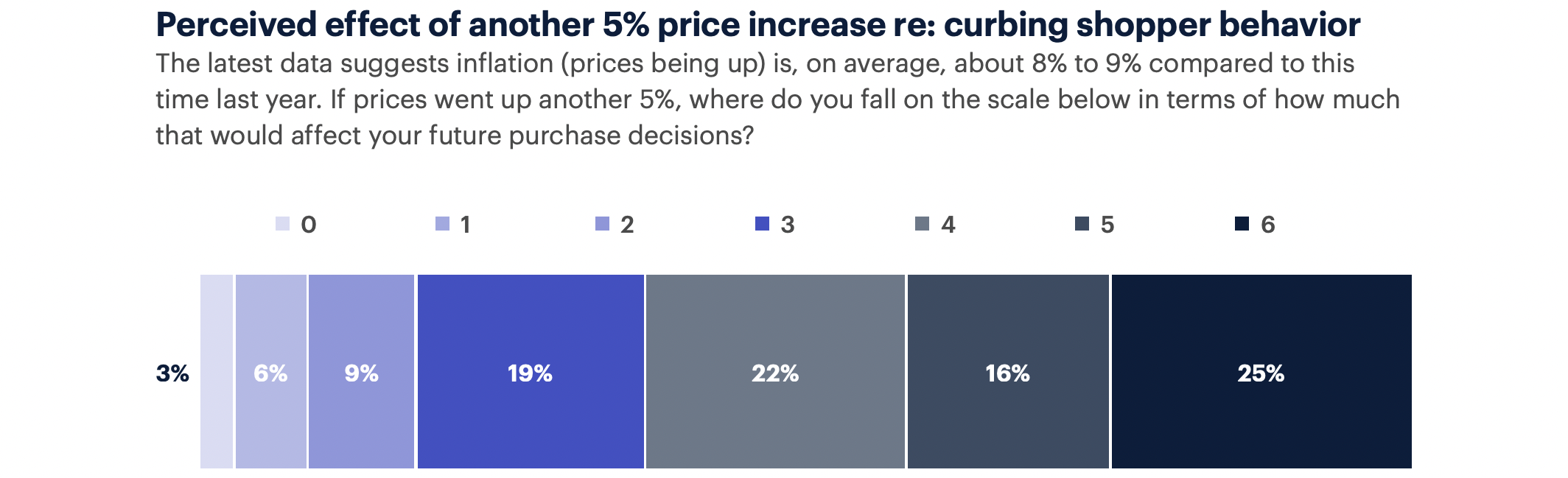

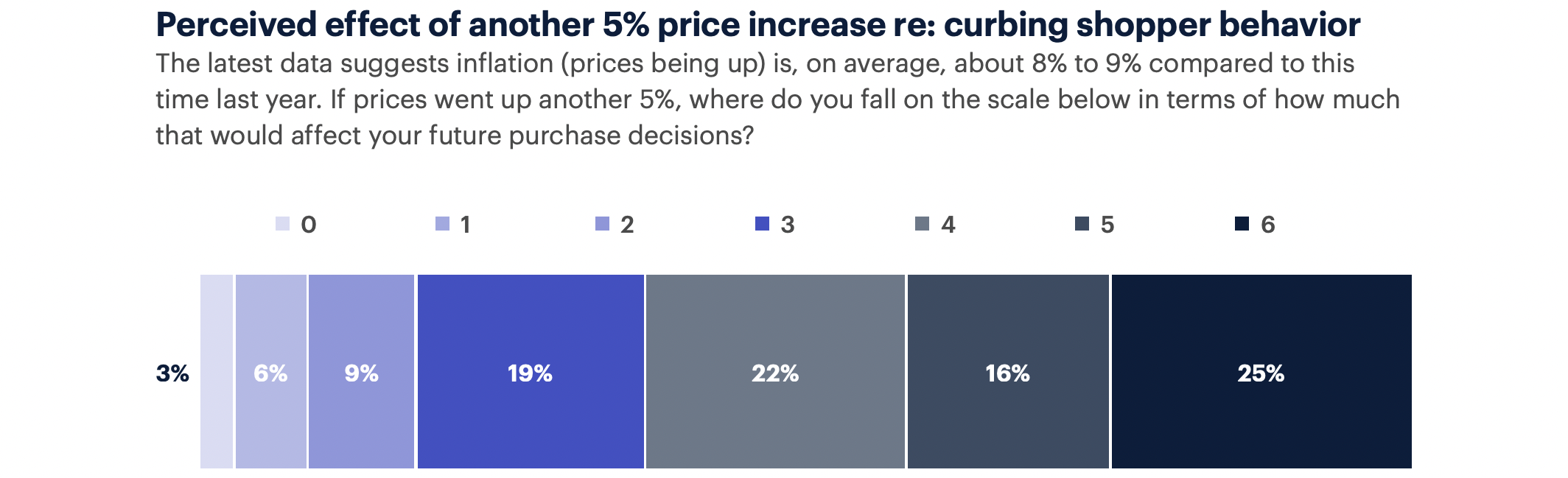

5. If the cost of goods and services were to increase by another 5%, all but 3% of consumers say the added cost would affect their future purchase decisions.

Know How to Respond to an Inflationary Market

Periods of high inflation and shrinking consumer spend are certainly challenging times for business growth. However, savvy leaders have the opportunity to adapt their strategies to foster and sustain consumer loyalty. You can too, by figuring out your competitive advantage and value proposition and getting smarter at benchmarking your performance.

Check out the full Medallia Market Research report, Consumer Reactions to Inflation, to learn about the most important steps your brand can take to respond to inflation and outperform the competition.